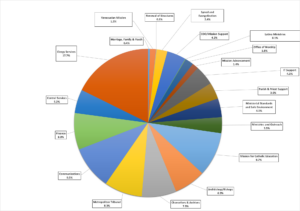

There are two primary ways parishes are involved in a flow of funds to the Archdiocese: through parish assessment and through insurance and benefits payments.

Common platform insurance and benefits are supervised by archdiocesan staff and governed by function‐unique committees and boards of trustees. These include:

- Irrevocable Trust

- Lay and Priest Pension Plans

- Archdiocese of Saint Paul and Minneapolis Medical Benefit Plan for Lay and Priests (AMBP)

- 403(b) Plan

Additional Information for Parish Staff: Find information regarding the Parish Financial Report, Annual Parish Representation Letter, proxies, budget planning, agreed‐upon procedure (AUP) requirements and more on Mission Support.